TL;DR: Key Findings From the AI Cost Governance Report

The AI Cost Governance Report shows how AI costs are reshaping margins, forecasting accuracy, and hybrid economics for enterprises worldwide. Heading into 2026, leaders must treat AI as a structural cost driver, embed visibility across hybrid environments, and enforce forecasting discipline to protect profitability.

Key takeaways:

- 84% of companies report AI costs eroding gross margins.

- 67% are planning or evaluating repatriation of AI workloads.

- Only 15% can forecast AI costs within ±10%.

- Token fees are not the top driver—data platforms, GPUs, and network charges dominate.

- Companies that monetize AI show 2–3x stronger cost governance discipline.

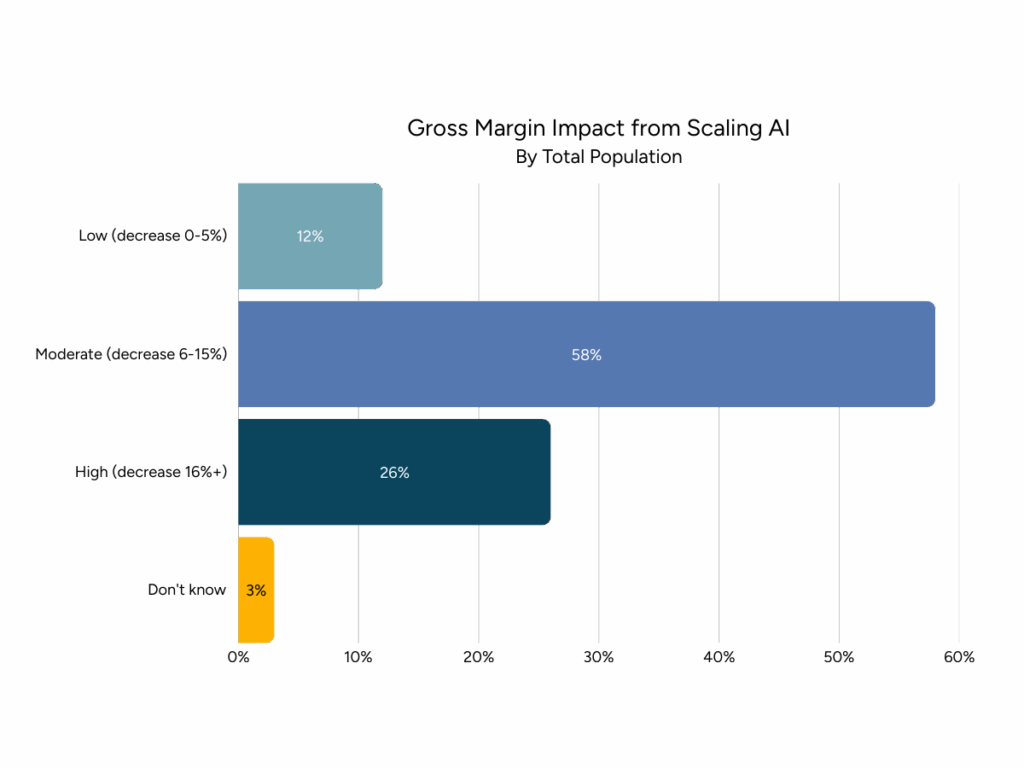

AI Costs Are Crushing Margins

According to the State of AI Cost Governance Report 2025, enterprises can no longer dismiss AI as an R&D experiment. According to our research:

- 84% of companies report AI costs cutting gross margins by more than 6%.

- 26% say the impact is 16% or more.

For SaaS and AI-native vendors, these expenses are not “innovation costs.” They are cost of goods sold (COGS). Without governance, margin erosion becomes inevitable.

What this means: CFOs must elevate AI cost control to the same priority as cloud or SaaS spend management. Margin targets for 2026 will not hold without proactive governance.

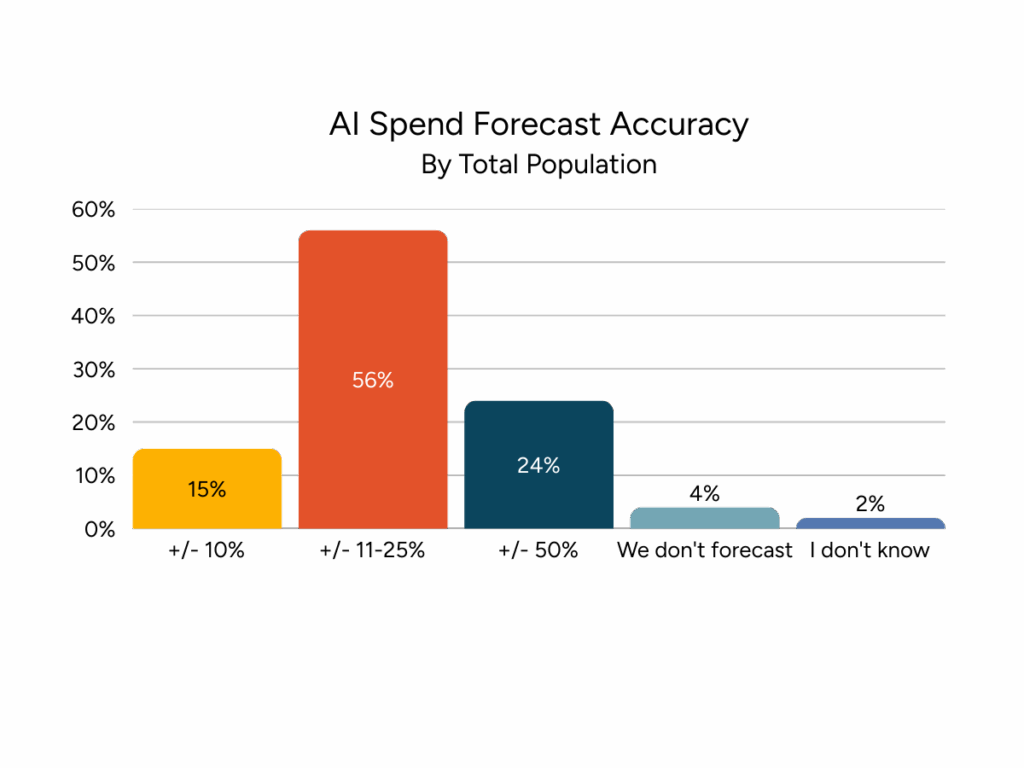

Forecasting AI Spend Is Broken

Budgeting tools built for cloud workloads are failing in the AI era. The data shows:

- Only 15% of companies forecast AI costs within ±10%.

- 56% miss by 11–25%.

- Nearly 1 in 4 miss by more than 50%.

Even minor changes in a prompt, model version, or agent workflow can spike GPU hours or token consumption by 100x overnight.

What this means: Finance leaders need forecasting models that capture AI’s volatility, tracking cost per inference, cost-to-serve, and feature-level unit economics.

Visibility Gaps Across Hybrid Infrastructure

AI workloads rarely run in a single environment. Our survey revealed:

- Only 35% of companies include on-prem AI costs in reporting.

- Half of companies with AI-core products do not track LLM API costs.

- 61% operate hybrid AI environments blending cloud, on-prem, and third-party GPU providers.

What this means: CIOs and CTOs need unified visibility across every environment. Without it, AI costs fall into “miscellaneous” categories, blocking chargeback, governance, and accountability.

Hybrid and Repatriation Are Rising

A wave of repatriation is underway:

- 67% of companies are actively planning to repatriate AI workloads to owned infrastructure.

- Another 19% are evaluating the move.

- In enterprises >$250M, Azure adoption now exceeds 82%, overtaking AWS.

What this means: Hybrid AI economics now extend beyond cloud + private data centers. Companies blend hyperscalers, GPU providers like CoreWeave, repatriated clusters, and local data platforms. Each decision directly impacts gross margins.

Beyond Tokens: The Real AI Cost Surface

Many organizations assume token usage is the main driver of AI spend. Our data shows otherwise:

- 56% cite data platform usage as their #1 unexpected cost.

- 52% cite network access and egress fees.

- Token costs rank fifth at 37%.

What this means: Token tracking is insufficient. AI cost governance must span compute, storage, APIs, data pipelines, and network traffic.

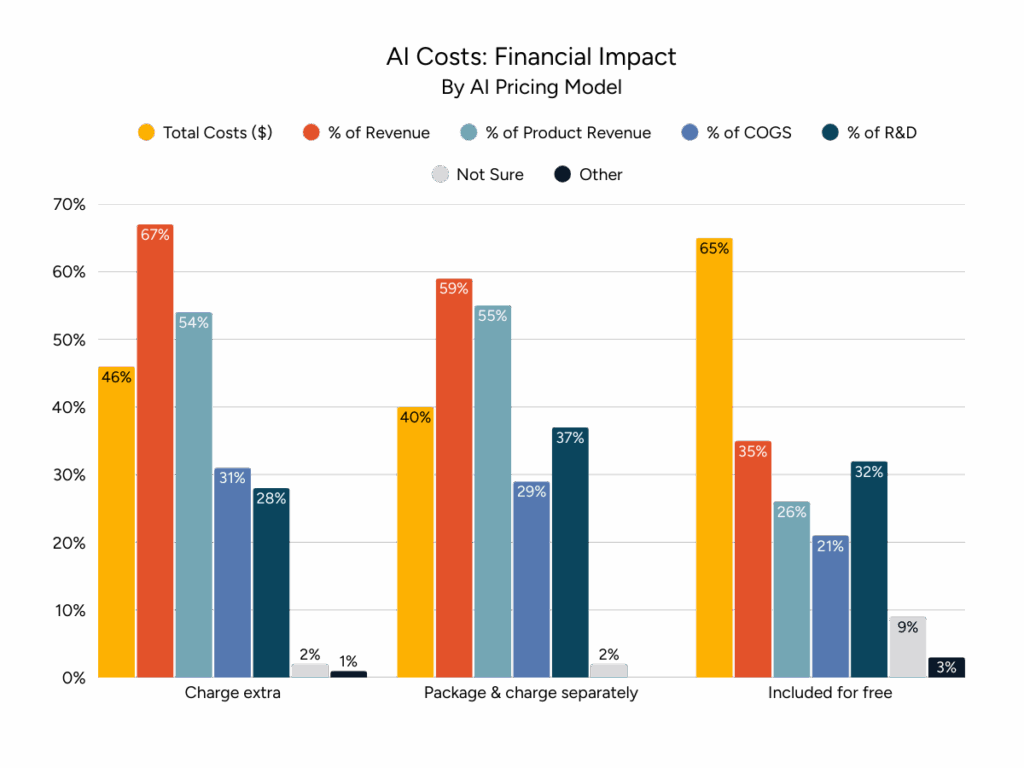

Revenue Accountability and Cost-to-Serve Discipline

Companies charging for AI are building better governance muscles:

- 70% of monetizing companies can track cost-to-serve precisely, compared to 29% of those offering AI for free.

- 71% use real-time alerts vs. less than half of “free” providers.

- They are 2–3x more likely to attribute costs by customer, product, or model.

What this means: Monetization creates accountability. Providers that continue to “give away” AI features risk margin loss and missed financial discipline.

What Leaders Must Do Before 2026

For CFOs

- Treat AI as COGS, not experimental spend.

- Make forecast accuracy a KPI across all AI projects.

- Demand unit economics: cost per inference, cost-to-serve, gross margin by product.

For CIOs & CTOs

- Invest in unified cost visibility across hybrid environments.

- Implement chargeback/showback models for GPUs, APIs, and data platforms.

- Treat repatriation as a financial strategy, not just an engineering decision.

For Product Leaders

- Tie pricing strategy directly to cost insights.

- Evaluate margin impact for every AI feature or agent workflow.

- Use cost-to-serve data to inform packaging and adoption strategies.

The 2026 Imperative

As the State of AI Cost Governance Report 2025 shows, AI is no longer a side project, it is a structural cost reshaping corporate financials. As one data point makes clear:

84% of companies already report margin erosion from AI costs.

The winners in 2026 will not be those with the flashiest AI features. They will be the enterprises that can see, forecast, and govern the true cost of AI.

Access the full State of AI Cost Governance report here.

FAQ: AI Cost Governance, Forecasting, and Hybrid Economics

Q: What is the State of AI Cost Governance Report 2025?

A: A survey of 372 companies conducted by Mavvrik and Benchmarkit, analyzing AI costs, forecasting accuracy, margin impact, and hybrid adoption.

Q: Why are AI costs harder to manage than cloud costs?

A: AI introduces new cost units, tokens, GPU hours, inference jobs. where minor changes in usage can spike spend by 100x.

Q: What actions should CFOs take ahead of 2026 planning?

A: Treat AI as COGS, enforce forecasting KPIs, and demand unit economics like cost-to-serve and feature-level margin tracking.

Q: Why are AI forecasts so unreliable compared to cloud forecasts?

A: Traditional cloud costs scale linearly with resources like VMs or storage. AI costs depend on model size, GPU utilization, and token usage, which can change 100x overnight with a new prompt or agent workflow.

Q: What are the biggest margin risks from AI adoption?

A: Unexpected costs from data platforms, network egress fees, and GPU spikes erode gross margins. In our research, 84% of companies reported AI costs cutting margins by more than 6%.

Q: How does repatriation affect AI cost management?

A: Repatriating workloads from the cloud to owned infrastructure helps enterprises control margins by reducing reliance on hyperscaler pricing. However, it requires governance tools to track hybrid environments.

Q: What cost metrics matter most for AI governance?

A: Key metrics include cost per inference, cost-to-serve, gross margin by product, and GPU utilization efficiency. These reveal the true unit economics of AI adoption.

Q: How can finance leaders prevent AI cost overruns?

A: Set forecasting accuracy as a KPI, implement real-time cost alerts, and demand cross-environment visibility. Partnering with IT and product teams ensures financial controls are built into AI initiatives.

Q: How does Mavvrik help enterprises govern AI costs?

A: Mavvrik unifies visibility across cloud, on-prem, and AI; tracks GPU/token spend; automates chargeback; and delivers predictive alerts to prevent surprises.